Unequal Burden

In our first of 3 posts on how to approach executive stock options, we covered how to evaluate when to sell your options as the stock price moves up and down. In this post, we will cover the 2nd important factor. Taxes.

Three Key Factors

- Stock Price

- Taxes

- Cash Flow - Your Life

If you decide to sell your stock options without factoring in the tax effect, you may be leaving significant money on the table...

Taxes do not apply equally to everyone. Are you surprised? Probably not. But how do you make good tax decisions, especially when the tax code is so complex and has so many moving parts?

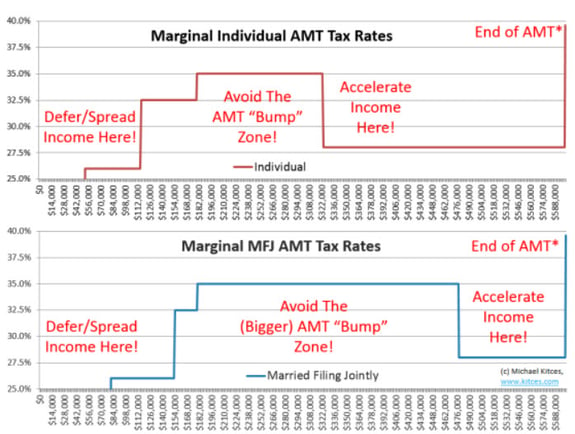

SimplifyTo simplify this process, I turn to a great communicator of financial concepts named Michael Kitces. The picture below is an excellent example of Michael's work, in that it turns a mind numbing concept like the Alternative Minimum Tax (AMT) into a picture. A picture of a bump no less.

.

.

As you can see, the picture speaks three very important words. Avoid the Bump!

The bump is the biggest impact of the AMT that runs from $154,000 up to approximately $476,000 for a couple who is Married Filing Jointly. If your income is in this range and you've been sitting on stock options without a clear plan for when to sell them, it would behoove you to consider the bump.

The way to approach the bump is to either accelerate or decelerate your income to get out of it. For people with stock options, you have the luxury of being able to do this by choosing when, and by how much to exercise your stock options.

Combining the AMT analysis with the stock price decisions that we covered in Part I, now addresses 2 of the 3 legs of the stool and gives you a very powerful approach to start making optimal decisions.

In our next post, we will cover the last leg, Cash Flow - Your Life, and tie all of the pieces together.